Tax refund services – Driving your efficiency forward!

VAT and excise duty refund services designed for transportation companies across Europe.

-

Pan-European VAT refunds on fuel, tolls, maintenance, accommodation and more

-

Excise duty recovery for diesel in eligible EU countries

-

Pre-financing options for faster liquidity

-

Full service: invoicing, compliance, submission and communication with relevant authorities

Simplify your cross-border tax recovery and improve your cash flow with our service provider Edenred Finance, a specialist in tax refunds.

Simplify your VAT and excise duty refunds across Europe

Integrated tax solutions can simplify and expedite the VAT recovery process – ensuring compliance, reducing administrative effort and providing faster access to refunds.

-

Pan-European coverage

Reclaim VAT and excise duty in up to 30 countries. -

Full service administration

From invoice checks to communication with tax authorities – our partner manages the process from beginning to end. -

Improved cash flow

Through pre-financing options, you can receive refunds within days instead of waiting for months.

-

Expert support and compliance

Our partner’s tax specialists ensure all claims meet local requirements, reducing errors and maximising returns.

-

Online tracking and transparency

Track the status of all your refunds in real time via fully secure, multilingual digital dashboards and refund calculators. -

One consolidated invoice

Tax refunds, fuel transactions, and toll settlements - all on one invoice.

VAT refund

Reclaim value-added tax on cross-border business expenses.

If your company pays VAT in a European country in which it is not registered, you may be eligible for a full or partial refund.

The VAT refund service covers a broad range of eligible expenses and provides improved financial flexibility.

Eligible expense categories

Business-related expenses can cover a wide range of costs, including fuel, tolls and tunnel charges. They also extend to maintenance and repairs necessary to keep vehicles in proper condition. In addition, accommodation and business travel fall under this category, along with expenses such as parking, training, and various other related needs.

Comprehensive service

The full VAT recovery process is managed – from invoice collection and validation to claim submission and communication with relevant tax authorities. Digital tools ensure transparency while claims are checked for compliance with local regulations.

VAT refund services:

-

Standard VAT refund

The full VAT refund process is handled, from invoice verification to communication with tax authorities. Suitable for businesses with standard processing timelines.

-

Fast VAT refund (fuel and toll invoices only)

Designed for immediate liquidity needs. Eligible refunds for fuel and toll invoices can be processed in as little as 14 business days.

-

Due date VAT refund

Prefinancing option for VAT refunds, with payment issued 30 days after the end of each quarter. This service offers earlier access to VAT refunds compared to standard timelines, with predictable quarterly payouts to support your financial needs.

Excise duty refund

If your transportation business is registered in the EU and you fuel your vehicles with diesel in eligible countries, you may be entitled to reclaim part of the excise duty paid on that fuel.

Excise duty refunds can represent significant cost savings for fleets operating in EU jurisdictions.

Refunds for diesel fuel are available in:

France, Belgium, Slovenia, Hungary, Italy, Croatia and Spain

Comprehensive service

All country-specific procedures are coordinated, including documentation and appeals where necessary. Claims comply with evolving regulations, enabling faster access to funds with minimal administrative effort.

Excise duty refund services:

-

Standard excise duty refund

The full administrative process is coordinated – from invoice validation and submission to correspondence with relevant tax authorities. Ideal for businesses with standard reimbursement timelines.

-

Due date excise duty refund

A pre-financing solution for excise duty refunds, providing payment 30 days after the end of each quarter. This enables faster access to reclaimed excise amounts compared to standard refund processes.

One partner. One invoice. Maximum value.

Combine tax refund services from Edenred Finance with fuel and toll solutions from UTA Edenred and receive:

-

An attractive discount on refund service commission

-

All-around support for your mobility needs

-

Offset tax refunds against outstanding amounts with UTA Edenred

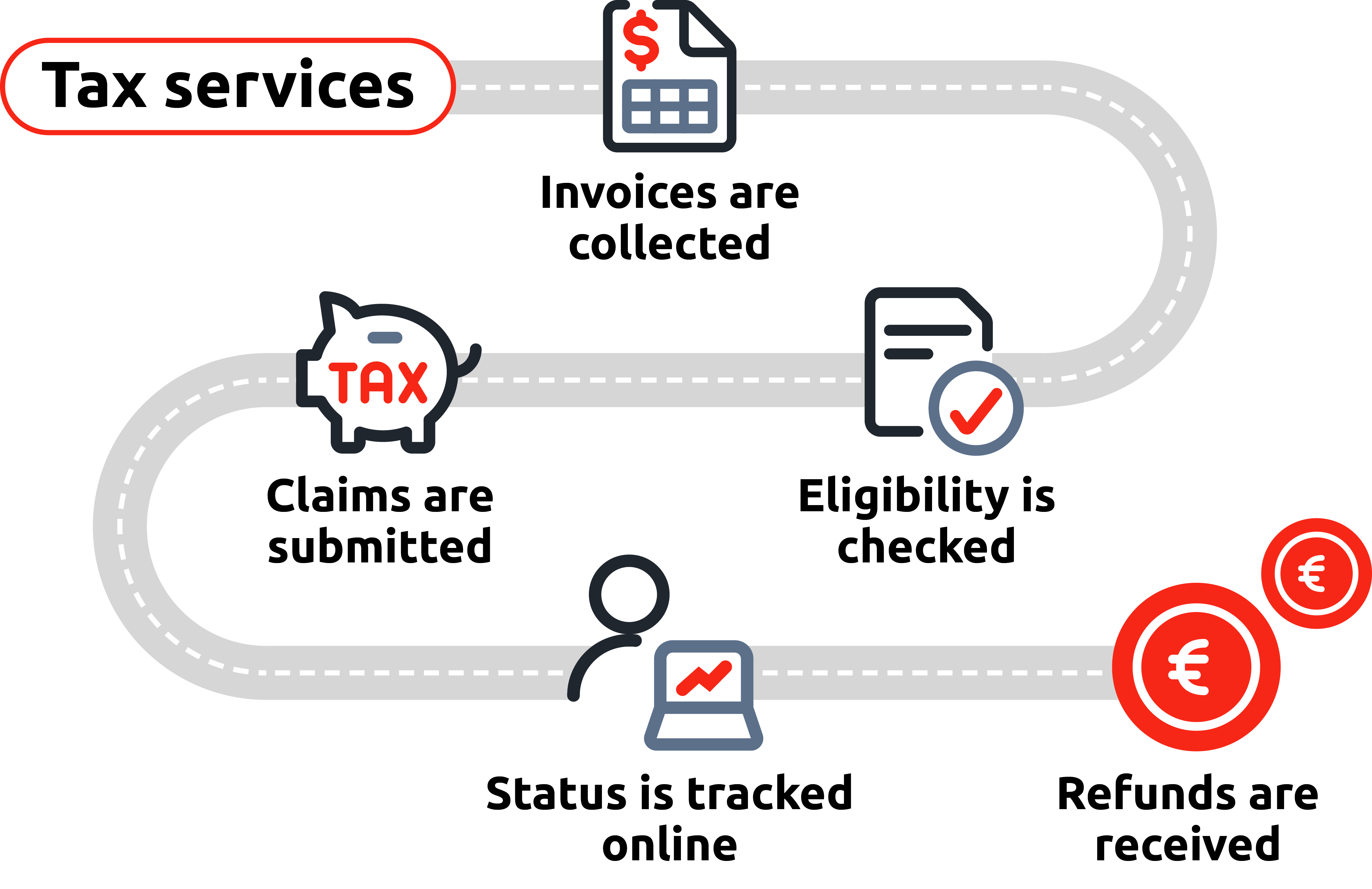

How it works

- Invoices are collected

- Eligibility is checked, and claims are prepared

- Claims are submitted and communication with relevant authorities is managed

- Status can be tracked online

- Refunds are issued quickly and efficiently

We simplify what slows you down

Outsource your refund process to Edenred Finance which speaks the language of European tax compliance – and your business.

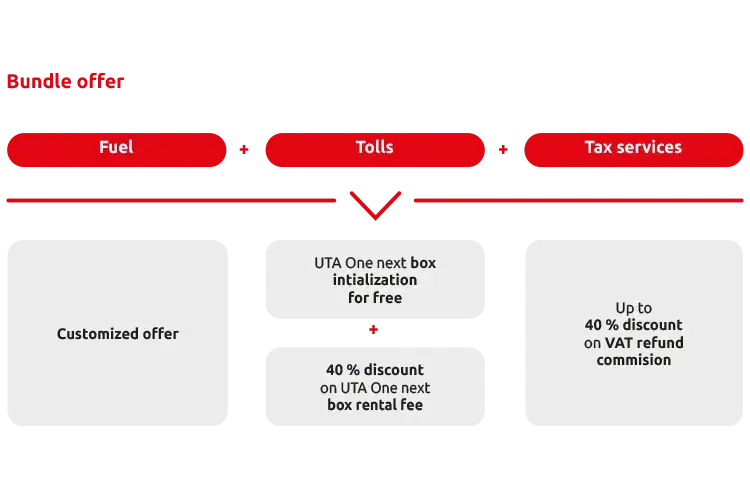

Everything you need in one bundle: Fuelling, toll settlement and tax services

Less effort. More savings. Full control.

-

Fuelling: Obtain discounts via a fuel card tailored to the size and composition of your fleet.

-

Toll processing: Begin saving right away with our UTA One® next on-board unit: It’s activated free of charge and you can also obtain a 40% discount* on the rental fee.

-

Tax services: Cut your tax processing costs and receive up to a 40% discount* on the commission for sales tax refunds on fuel, tolls, maintenance, accommodation, and more.

-

Get essential mobility services from a single supplier – fuelling, toll settlement and tax services in one package tailored to your business requirements.

-

Start to save immediately by leveraging exclusive discounts: Benefit from price advantages over individual bookings and reduce administrative time and effort.

FAQ: VAT and excise duty refunds

The following are common questions related to tax services

Who is UTA Edenred’s tax refund service partner?

All VAT and excise duty refund services are delivered by Edenred Finance, a specialist Edenred Group entity that focuses on tax recovery solutions for the European transportation and logistics sector. Compliance with local regulations is ensured and standard and pre-financed refund options are available.

Who is eligible for a VAT refund?

Eligibility applies to companies registered for VAT in their home country, incurring business expenses in European countries where they are not VAT-registered. Conditions typically include:- No permanent base in the refund country

- Business-only use of purchased goods and services

- Valid invoices in the company name

- Meeting minimum claim thresholds (€400 for partial-year claims, €50 for annual claims)

Who is eligible for an excise duty refund?

Eligibility applies to transportation companies registered in an EU country, operating vehicles weighing at least 7.5 tonnes, fuelling diesel in eligible EU states and holding valid itemised invoices. Fuel must be for commercial use and meet country-specific documentation and minimum volume requirements. HVO fuel may be eligible in some countries.

In which countries are VAT and excise duty refunds available?

You can request a VAT refund for eligible business expenses incurred in the following 31 European countries, provided your company meets applicable conditions: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland and United Kingdom.

Excise duty refunds are available in: Belgium, Croatia, France, Hungary, Italy, Slovenia and Spain.

Eligibility depends on local VAT laws and the type of expenses claimed. Refund conditions (rates, deadlines, documentation) vary by country.

Would you like to learn more about our tax refund service?

Use our contact form and we'll get back to you shortly.